US energy giant says renewables and batteries beat coal, gas and nukes

The head of NextEra Energy, the biggest and most successful utility in the United States says the energy industry is in the grip of massive change, with the cost of renewables and battery storage – without subsidies – beating gas, as well as existing coal and nuclear on costs.

“We see renewables plus battery storage without incentives being cheaper than natural gas, and cheaper than existing coal and existing nuclear,” Jim Robo, the CEO, president and chairman of NextEra, told analysts last week at the Wolfe Utilities & Energy Conference.

“And that is game changing,” Robo said. So much so, that renewables would likely replace coal generation in the US within a decade.

To put these comments into context, NextEra is a huge company with $US17 billion ($A25 billion) of revenues, 46GW of energy assets, and 14,000 employees, and a market value of around $US114 billion ($A170 billion).

In short, it’s nearly as big as the entire Australian grid.

Robo noted that the US government’s Energy Information Administration expects that the world’s biggest electricity market could reach 35 per cent renewables by 2030. Robo says it could be as high as 50 per cent by 2030, and could ultimately be 70-75 per cent by 2050.

“I think that’s very doable, and that would take out an enormous amount of carbon out of the United States. And at the same time bring rates down across the country.

“And that’s the thing that I think people still haven’t grasped – that you can be green and low cost at the same time and that it’s terrific for customers, it’s terrific for the environment and it’s great for shareholders as well.

“It really is good all around. And we’re leading the charge on disruption there, and I’m very excited about the growth prospects.”

Robo’s comments are significant for a number of obvious reasons. Close watchers of the US energy market will already be aware that the cost of wind and solar has fallen dramatically, and recent auctions for “dispatchable” energy has seen renewables and battery storage projects beating out gas, which is significantly cheaper in the US than in Australia.

Robo’s comments are significant for a number of obvious reasons. Close watchers of the US energy market will already be aware that the cost of wind and solar has fallen dramatically, and recent auctions for “dispatchable” energy has seen renewables and battery storage projects beating out gas, which is significantly cheaper in the US than in Australia.

And the fact that renewables and storage, without further incentives, can beat out existing coal and nuclear plants, most of which have been fully depreciated, is just as significant. As is Robo’s point that “you can be green and low cost” at the same time. And, as he also notes, can deliver reliable power as well.

“You still have coal being roughly 35 per cent of the energy generated last year and effectively, we think renewables can replace almost all of that by 2030,” Robo said in response to a question.

“When you look at wind and solar paired with a battery, new construction is cheaper than the operating cost of existing coal.

“So there’s very little reason from an economic standpoint to continue to run those units and there’s very little reason from a reliability standpoint to run those units and there’s certainly no reason from an environmental standpoint to run them.

“So we see a massive shift there in terms of much of the coal in the country being phased out by 2030.”

Even in Australia, the cost advantage of renewables and storage is recognised by the CSIRO and the Australian Energy Market Operator, and by most of the major utilities in the country, and leading analysts.

But it’s not yet widely accepted in the political debate, or even in mainstream media. The federal government is now looking at nuclear as an option, despite the fact that the cost of new nuclear is many times the cost of renewables and storage, even with a carbon price that would only narrow the difference in cost with coal.

In a speech in Sydney on Wednesday morning, energy minister Angus Taylor repeats his views that the amount of wind and solar in the system – around 15 per cent – is already too much, and says the “only realistic options to do most of that balancing are coal, gas and hydro.” No mention of batteries.

NextEra’s Robo, on the other hand, said battery storage cots are continuing to come down, and the amount of storage needed is often misunderstood. “For the first 1,000MW of battery storage, you probably only need 2 hours to really shape the peak,” he said.

“So I don’t think you need like giant step changes to get to 70% or 75% (renewables), honestly, with the existing grid.

“I mean, you see areas with — they have days in Texas and SPP (South-west Power Pool) where the penetration — the renewable penetration is well over 50%, right?

“So we know that we can run the grid on days with very high wind and very good resources. So you can run the system on that, and that’s with very little storage on those systems, right? So 4 hours of storage, we think, is the sweet spot for most systems that we’ve modeled. And you don’t really need a step change to be able to do that.”

Still, Robo doesn’t like targets that set absolutes like 100 per cent renewables, arguing that at 70 per cent renewables the emissions would be hugely reduced, and

“One of the reasons why you can’t get to 100% is you can’t — the battery you would have to build is so enormous, right, and it would have to be able to — you have to have a period where the wind wasn’t blowing at night for a very long period of time and this is where getting to the 100% is very expensive.

“Getting to 75% is going to be cheaper than the system we have now, right? And it’s just that last, that — the incremental piece, getting that last little bit out, from an economic standpoint, doesn’t make a lot of sense.

“It shouldn’t be the dictates where you’re saying, let’s say, be 100% off of this or 100% off of that. That’s just bad economics and it’s bad policy. And I think in the end, economics will win out in the long term.”

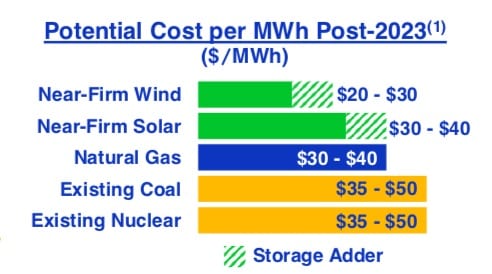

Robo said the outlook for existing nuclear in the US is mixed. In some regions the nuclear plants that it owns could compete, but in others, such as Iowa – where he said the cost of wind power and battery storage was around $US20/MWh, and the cash operating costs of existing nuclear about $US35-$40/MWh, it would lose out.

The company is doing two combined wind, solar and battery storage projects – one in Oregon and another in Oklohoma – as well as what will be world’s largest battery in Florida in the Manatee Bay area, the 400MW 2-hour battery that’s going to be online in 2021.

Tim Buckley, the director of energy finance studies at IEEFA, who was due to cite the presentation at a hearing into the federal government’s nuclear inquiry in Sydney on Wednesday afternoon, said Robo’s comments are significant because while they sounded like the “greenie nirvana view”, they came from the head of the biggest and most successful utility in the US.

“Capital markets and corporates are leading, technology is driving the disruption, and the government is being left behind with outdated views of the world. We’re talking of the US, but the same applies here in Australia,” he told RenewEconomy.

Buckley pointed out that while wind and solar are achieving prices of around US$20-30/MWh in the US now, the includes a 30% investment tax credit. That expires after 2020, but what Nextera is saying very clearly is that with 10% annual cost reductions likely to continue, then by 2022 or 2023 unsubsidised RE will be back to ~US$20-30/MWh, or ~US$30-40/MWh fully firmed, with no subsidies.

“As the US starts to export massive amounts of LNG, US domestic gas prices are likely to go up. Coal is dead by 2030 according to Nextera, nuclear and then gas get progressively eroded thereafter.”

And he notes that NextEra is not an isolated case. Another two big utilities have in the last two weeks made similar commitments – to vastly increase their investments in wind, solar and battery storage, and shut down their coal plants early.

Pacificorp, which operates in six western states of the US, last week released its 20-year “least cost” plan which outlined huge investments in solar, wind and battery storage, and the early closure of uneconomic coal generators. In the eastern states, Duke Energy has also fast-tracked the closure of its coal portfolio as part of plans to slash emissions by 50% by 2030.

No comments:

Post a Comment